Are Equity Release Mortgages the Most Suitable Option for You?

Are Equity Release Mortgages the Most Suitable Option for You?

Blog Article

A Comprehensive Overview to Picking the Right Equity Release Mortgages for Your Requirements

Picking the best equity Release home loan is a substantial choice for numerous home owners. It involves recognizing various products and examining personal economic needs. With options like life time home mortgages and home reversion plans, the path can seem complicated. Trick factors to consider consist of rate of interest and versatility. As individuals browse this landscape, considering potential risks and advantages ends up being important. What factors should one focus on to ensure the best outcome?

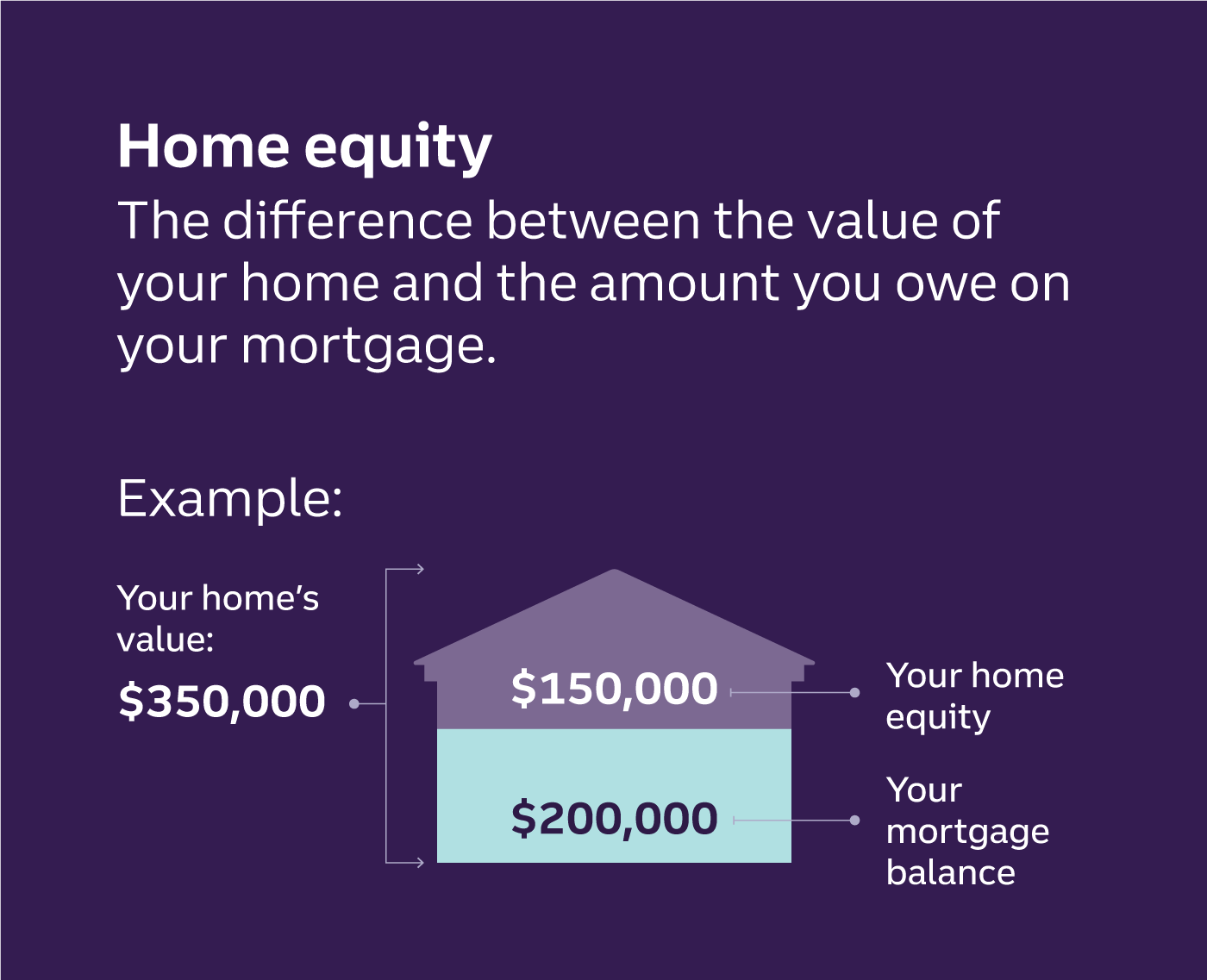

Recognizing Equity Release Mortgages

Equity Release mortgages provide an economic service for property owners aiming to access the value secured their residential properties. Primarily developed for individuals aged 55 and over, these home mortgages allow them to convert part of their home equity into cash while proceeding to reside in their homes. Property owners can utilize these funds for numerous functions, such as supplementing retirement revenue, moneying home enhancements, or covering health care prices. The core principle behind equity Release is that the lending is paid off upon the property owner's fatality or when they move right into lasting treatment, whereupon the residential or commercial property is typically offered to resolve the financial obligation. This approach allows people to enjoy the advantages of their home's worth without needing to transfer. It is essential for potential borrowers to comprehend the effects of equity Release, consisting of potential influence on inheritance and continuous financial commitments, before choosing.

Sorts Of Equity Release Products

When exploring equity Release items, it is essential to understand the main kinds offered. Life time home loans, home reversion schemes, and drawdown strategies each deal distinct features and benefits. Evaluating these choices can aid people in making educated financial choices concerning their home.

Lifetime Mortgages Explained

Life time mortgages represent among one of the most usual types of equity Release products available to house owners in retirement. This type of home mortgage enables individuals to obtain against the worth of their home while keeping ownership. Typically, the funding and rate of interest built up are paid off when the property owner dies or relocates right into long-lasting care. Customers frequently have the alternative to select between set and variable interest prices, in addition to whether to make month-to-month repayments or let the passion roll up. The amount readily available to borrow usually depends on the home owner's age and residential property worth. This economic solution can offer retirees with essential funds for different requirements, including home renovations or added earnings, while permitting them to stay in their homes.

Home Reversion Schemes

:max_bytes(150000):strip_icc()/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

Drawdown Plans Introduction

Drawdown strategies represent a versatile option within the spectrum of equity Release items, allowing home owners to access their residential property's value as required. These plans make it possible for people to Release a part of their home equity incrementally, instead of obtaining a swelling amount upfront. This flexibility can be particularly helpful for managing funds gradually, as consumers only pay rate of interest on the quantities they take out. Normally, drawdown strategies include a pre-approved limitation, guaranteeing that property owners can access funds when needed without reapplying. Furthermore, this technique can aid alleviate the influence of compounding passion, as less money is borrowed originally. On the whole, drawdown strategies cater to those seeking economic versatility while keeping control over their equity Release journey.

Key Factors to Take Into Consideration

When choosing an equity Release home mortgage, several key aspects warrant cautious consideration. Interest prices comparison, the loan-to-value proportion, and the versatility of functions provided can greatly influence the viability of a product. Evaluating these components will help individuals make notified decisions that line up with their economic goals.

Rates Of Interest Comparison

Navigating the landscape of equity Release mortgages requires mindful consideration of rates of interest, which play an important duty in determining the overall cost of the loan. Customers need to contrast fixed and variable rates, as repaired prices supply stability while variable prices can fluctuate based on market conditions. In addition, the timing of the interest price lock-in can substantially influence the overall payment quantity. Possible debtors have to also examine the interest rate (APR), that includes different costs and expenses connected with the home mortgage. Understanding the effects of different rates of find this interest will enable people to make educated choices customized to their monetary circumstance. Ultimately, a comprehensive analysis of these elements can result in extra beneficial equity Release results.

Loan-to-Value Ratio

The loan-to-value (LTV) ratio works as a critical statistics in the domain of equity Release home mortgages, affecting both qualification and loaning ability. It is computed by splitting the quantity of the funding by the assessed worth of the residential or commercial property. Typically, a greater LTV proportion indicates a better risk for lending institutions, which can lead to more stringent financing requirements. Many equity Release products have certain LTV limits, commonly identified by the age of the borrower and the value of the residential or commercial property. LTV ratios normally range from 20% to 60%, depending upon these variables. Recognizing the implications of the LTV proportion is necessary for customers, as it straight influences the amount they can access while guaranteeing they continue to be within secure loaning restrictions.

Versatility and Attributes

Comprehending the versatility and features of equity Release home mortgages is necessary for borrowers looking for to maximize their monetary alternatives. Various products offer differing levels of adaptability, such as the capability to make partial settlements or the choice to take a round figure versus regular withdrawals. Customers must likewise think about the mobility of the home mortgage, which allows them to transfer it to a brand-new property if they make a decision to move. Extra attributes like the capacity to consist of relative or the choice for a no-negative-equity guarantee can enhance protection and peace of mind. Inevitably, reviewing these factors will certainly aid borrowers choose a strategy that aligns with their long-term personal scenarios and monetary objectives.

The Application Process

Exactly how does one navigate the application process for equity Release mortgages? The journey starts with reviewing eligibility, which normally requires the applicant to be at least 55 years of ages and own a considerable section of their home. Next, people should collect required documentation, including proof of earnings, identification, and building valuation.Once prepared, candidates can approach a loan provider or broker concentrating on equity Release. An economic advisor might likewise provide valuable advice, guaranteeing that all choices are considered. Following this, the candidate submits a formal application, that includes a detailed analysis of their financial circumstance and property details.The loan provider will then conduct an appraisal, which might involve a home assessment and discussions regarding the candidate's needs and scenarios. The process culminates with a formal offer, permitting the candidate to examine the terms before making a last choice. Clear communication and understanding at each step are vital for a successful application.

Costs and expenses Involved

Various expenses and fees are associated with equity Release home loans, and potential debtors must understand these economic considerations. At first, there might be an application fee, which covers the lender's management prices (equity release mortgages). Additionally, evaluation charges are typically called for to evaluate the residential or commercial property's worth, and these can vary considerably based on the residential or commercial property's dimension and location.Legal charges need to also be factored in, as borrowers will need a lawyer to browse the lawful facets of the equity Release procedure. Additionally, some loan providers may enforce early payment fees if the home loan is settled within a particular term.It is essential for consumers to extensively evaluate all prices connected with an equity Release mortgage, as they can influence the total value of the equity being launched. A clear understanding of these charges will make it possible for individuals to make educated choices

Possible Threats and Advantages

Equity Release mortgages come with a range of costs and costs that can affect a customer's economic scenario. They give substantial benefits, such as accessibility to funds without the need to sell the home, enabling consumers to use the cash for retirement, home enhancements, or to support household participants. Nevertheless, prospective dangers exist, consisting of the decrease of inheritance for heirs, as the loan amount plus passion have to be paid back upon the borrower's fatality or relocate into long-term care. In addition, the residential property's value might not value as anticipated, leading to a bigger financial obligation than anticipated. Customers may additionally deal with constraints on relocating or marketing the residential or commercial property. It is necessary for individuals to thoroughly weigh these threats against the benefits to identify if equity Release lines up with their long-lasting monetary objectives. A thorough understanding find more of both facets is essential for making an educated decision.

Questions to Ask Prior To Committing

When thinking about an equity Release mortgage, possible consumers should ask themselves several essential inquiries to ensure they are making an informed decision. They need to initially assess their monetary scenario, consisting of existing financial obligations and future demands, to identify if equity Release is appropriate. It is vital to make inquiries regarding the total costs included, including costs, passion prices, and any type of penalties for very early payment. Customers need to likewise ask how equity Release will certainly affect inheritance, as it may reduce the estate left for beneficiaries. Comprehending the regards to the contract is essential; consequently, concerns regarding the flexibility of the plan, such as the ability to make settlements or take out extra funds, must be addressed. Potential debtors need to consider the track record of the lender and whether independent monetary advice has actually been looked for to guarantee all aspects are extensively understood.

Regularly Asked Concerns

Can I Choose Just How Much Equity to Release?

People can normally pick just how much equity to Release from their property, however the amount might be influenced by aspects such as age, property value, and loan provider demands - equity release mortgages. Consulting with a financial consultant is recommended

What Takes Place if Residential Property Worths Decline?

If residential property values lower, the equity offered for Release diminishes, possibly resulting in a circumstance where the outstanding home mortgage surpasses the property worth. This circumstance might limit monetary alternatives and impact future planning for homeowners.

Can I Still Move Home With Equity Release?

The ability to move home with equity Release relies on the specific regards to the equity Release strategy. Typically, discover here lots of plans enable property owners to transfer their equity Release to a new residential or commercial property, subject to approval.

Just How Does Equity Release Impact My Inheritance?

Equity Release can significantly affect inheritance. By accessing home equity, the total worth of an estate might reduce, potentially decreasing what beneficiaries obtain. It's crucial for people to consider these ramifications when choosing on equity Release choices.

Exist Any Age Limitations for Applicants?

Age constraints for equity Release candidates usually require individuals to be at the very least 55 years old (equity release mortgages). Lenders might have added requirements, frequently thinking about the candidate's monetary circumstance and the residential property's worth throughout the examination process

Conclusion

In recap, picking the appropriate equity Release mortgage calls for cautious examination of private monetary circumstances and objectives. By understanding the numerous product kinds, vital elements, and connected prices, borrowers can make educated choices. In addition, acknowledging possible dangers and benefits is important for lasting financial stability. Looking for independent monetary guidance can further boost the decision-making process, guaranteeing that the chosen equity Release service aligns with the home owner's overall financial approach and future ambitions. Equity Release home mortgages supply a financial solution for home owners looking to access the value locked in their buildings. Comprehending the adaptability and features of equity Release home loans is important for consumers seeking to optimize their financial options. Some lending institutions might enforce early payment charges if the home loan is paid off within a certain term.It is crucial for borrowers to thoroughly assess all costs connected with an equity Release home loan, as they can affect the overall value of the equity being launched. The capacity to relocate home with equity Release depends on the specific terms of the equity Release strategy. Looking for independent monetary suggestions can better boost the decision-making procedure, ensuring that the selected equity Release remedy straightens with the home owner's total monetary approach and future goals.

Report this page